Providing relief to all the GST registered persons and tax professionals, the Last date for filing GSTR 9 and 9C for Financial Year 2019-20 has been further extended by the government from 28th February 2021 to 31st March 2021.

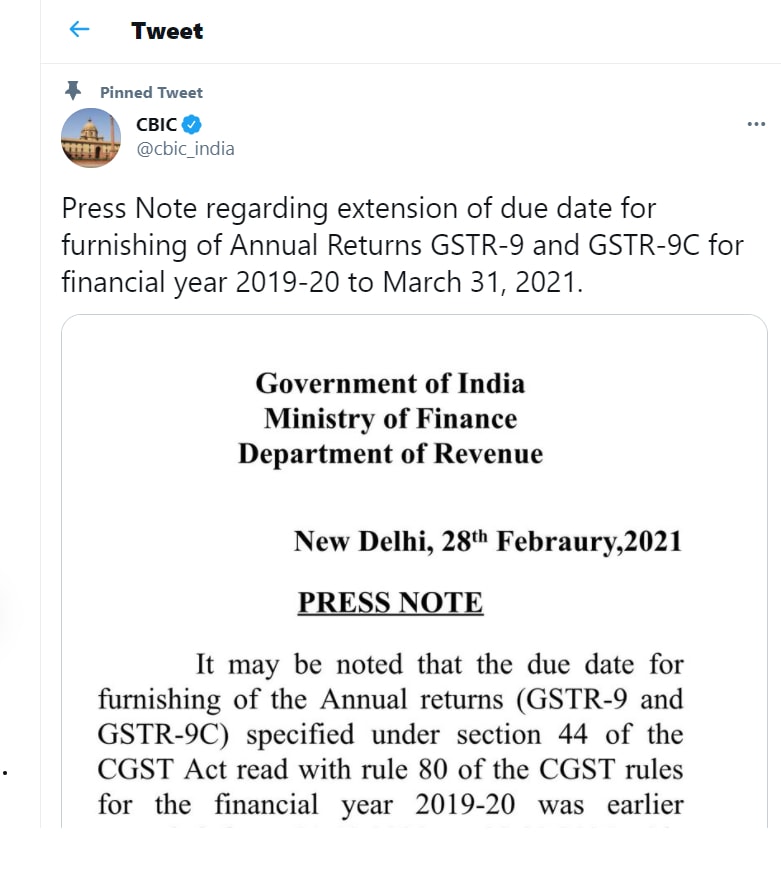

It has been once again the eleventh-hour announcement from the government regarding the return filing extension as has been the norm from the authorities. The news of the Annual Return extension broke out through a tweet posted by CBIC on social media at around 6 pm in the late evening of the last day.

The government has released a Press Note dated 28th February 2021 shared by CBIC over the tweet which informed that the due date for furnishing of the Annual Return i.e., Form GST 9 and GSTR 9C for the Financial year 2019-20 has been extended till 31st March 2021,

The Annual Return (GSTR 9 and GSTR 9C) is required to be filed by the registered person as per the requirement laid in Section 44 of CGST Act 2017 read with Rule 80 of the CGST Rules 2017.

For FY 2019-20, filing of Form GSTR 9 (Annual GST Return) is mandatory for registered taxpayers having turnover in excess of Rs 2 Crores while GSTR 9C which is the Audited Reconciliation Statement has to be filed by those registered taxpayers whose turnover is more than Rs. 5 Crores.

Earlier the date for GSTR 9 and 9C for FY 2019-20 was extended from 31st December 2020 to 28th February 2021 vide Notification No. 95/2020 Central Tax dated 30.12.2020.

The press note released by the government today in the late evening has stated that this extension of Annual GST return filing up to 31st March 2021 has been decided by the government in view of the difficulties faced by the taxpayers in meeting the deadline. The extension has been announced after the approval of the Election Commission of India in view of the upcoming elections announced in Bengal, Assam, Tamil Nadu, Kerala, and Puducherry.

The notification regarding the extension shall be issued in due time.

Tax Pyramid