At the time of inception of GST regime, it was assured to the states vide GST laws that there would be a 14% increase in states revenue for five years from 2017 to 2022. The shortfall in the states’ revenue would be compensated by the Centre which it planned to compensate through the levy of compensation cess on luxury and sin products. The prospects of GST collections in this financial year look quite meek and draws no inspiration. This led to the big crisis as how to fill that gap or shortfall.

States have been demanding timely payment of compensation from the Centre citing that it is the responsibility of the central government. Centre have been claiming that it is the Council to decide and reality is the cess collection is quite low to pay the compensation. Then it was left to the GST Council to resolve this dispute between states and central government. All decisions taken till date by the GST Council were unanimous but it was an easy guess that this time around it would be difficult to arrive at consensus.

Before heading further let’s try to understand how the compensation have been paid in earlier years.

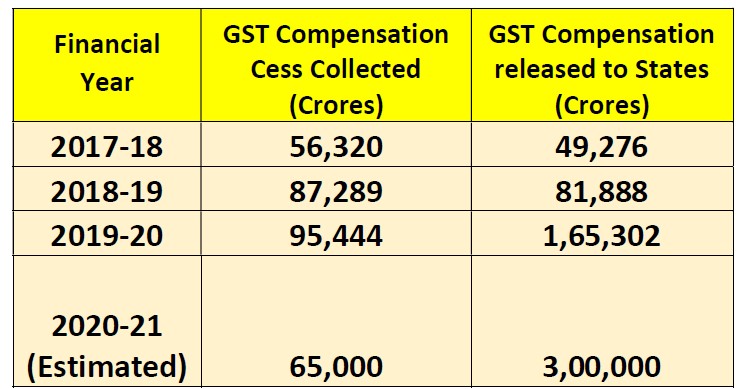

In First two years, 2017-18 and 2018-19, there were no problems as the required GST compensation released to States was easily met from the cess collected during the respective year. For FY 2017-18, Cess collected was Rs. 56,320 Crores while Compensation paid to states was Rs 49.276. Similarly, for FY 2018-19 cess collected was Rs. 87,289 crores while compensation paid to states for the year was Rs 81,888 crores.

The real issue cropped during the next year i.e. FY 2019-20 when the compensation required to be released to states got double in comparison to previous year but the collection of cess increased marginally to Rs. 95,444 crores leading to a huge gap to be filled. This was also evident from the fact that compensation pay to the states for the year got delayed and was cleared in July 2020 which was four months into the next finance year.

The opposition ruled states have alleged that the centre is delaying the compensation pay and this delayed release of compensation pay is affecting their various state level welfare schemes.

Covid pandemic and lockdown has drastically affected the business and GST collections. Dropped GST revenue hurts the government from two sides. On one side due to the reduced revenue, states collection gets reduced which in result widens the shortfall in its revenue leading to bulging of their GST compensation pay demand from the centre.

On the other side, the cess collection which was being used to settle off the compensation payment to the states are also reduced due to the less business activities.

Thus, where on one hand the required compensation to be released to states is increasing, at the same time the cess collection is also decreasing leading to a bigger gap.

The question was how to pay this compensation pay in this current scenario when compensation pay would not be able to fill the gap. This is the main reason of dispute which has drawn lines of new battleground between Centre and States.

Now let’s weigh the option which were at disposal, increasing revenue means increasing GST rate which obviously in this time when businesses are already dealing with a lot, cannot be considered a viable option. In fact, in order to boost the market, government has started to even evaluate the lowering of GST rates on certain commodities. The government has already given a nod to discuss the lowering of GST rate on two wheelers in the coming meeting of GST council approving the industry proposal regarding it.

The other option is borrowing the amount and then meeting out the shortfall out of it. But the big question arise here who is going to take the loan, State or the Centre. States can take loan as per their requirements but the States might not agree to it. As per the states, it is the duty of the Centre to fill the gap as was promised, so it is the Centre who should compensate them anyway for any shortfall. Experts are also of the opinion that instead of individual states taking the loan, Centre should take the loan on behalf of all the states. Borrowing option is also not easy as the interest cost, guarantee and repayment factors also needs to be reviewed carefully. The questions that loomed were obviously large.

Finance Minister during the press brief after the 40th GST Council Meeting had made it clear that the next GST Council meeting would be held only to resolve and discuss how to pay the compensation of revenue shortfall to the states. This meeting which was to be held in July but was postponed due to some technical issues and was later re-scheduled for August 27.

Finally, the awaited 41st GST Council meeting was held on 27th August 20 through video conferencing with a pre decided single dedicated agenda of discussing compensation pay for revenue shortfall to states. The collection during this time of corona pandemic has taken a huge dip and paying the compensation to states has been a big headache for the government.

There was immense pressure from states seeking payment of revenue shortfall which was promised to be compensated by Centre for initial five years of GST regime that too with annual 14% increment. The meeting as expected was a marathon one and took place for more than five hours. Centre made it clear that compensation would not be made from the Consolidated fund of India. It is to be met only through Cess collections and since the cess amount is not adequate for the time being so the fund requirements shall be met through borrowings.

As per the calculations presented by Centre, estimated compensation requirement of states could be around Rs 3 lakh crore for current financial year. While 65,000 crores are expected to be met through the cess collection. Cess was specifically levied for paying the compensation to the states. This leaves with a shortfall of around Rs. 2.35 lakh crore.

Revenue secretary, Ajay Bhushan Pandey, during the virtual media briefing, explained that this gap of Rs. 2.35 lakh crore is not entirely due to GST but also due to the Covid pandemic impact on the economy. Government worked out that Rs. 97,000 crores are due to the implementation of GST while the balance is due to the Covid pandemic effect. Two options have been placed before the states to deal with the shortfall.

These two options given by Centre to states are

- First option is that states can borrow the shortfall amount of Rs. 97,000 crores which is due to GST implementation at a reasonable interest rate worked out after consultation with RBI. Government is going to arrange for this special rate. Entire principal and interest portion will be paid to the states through the cess collection. The borrowed amount is to be repaid after ending of Five years (i.e. after June 2022) utilizing the Cess collection after that period.

- Second option put forth by Centre is that state can borrow the entire amount of Rs. 2.35 lakh crore shortfall under the provided special window. In this option states are to borrow from the market and hence the interest rates are likely to be on higher side. Further, only principal amount is to be covered by the cess collection. This is important as states opting this second option would have to bear the entire interest burden of the loan.

States were provided with seven days to think and chose between the two options.

The government clarified that these options or the arrangement would be available only for the current fiscal year. For the next year a review would be done at the start of the financial year through a Council meet in April 2021 and decision would be taken on the basis of the prevalent economic situation during that time about which government was hopeful might improve from the current scenario.

Government also clarified that revenue shortfall of states is anyway protected and would be paid to states after the end of five years not depending on the amount states decide to borrow. The option has been left to the states to decide the borrowing amount on the basis of their requirements as the borrowed amount has to be repaid after all.

The two options of borrowing given to states seems not to have gone down very well with the states mostly which are ruled by the opposition. These states want Centre to take the loan and they support their view by stating that it would be more convenient for the Centre to borrow and also it can raise funds at a cheaper rate.

Looking at the conflict and no unanimous opinion seems to be forming at this stage, the issue of GST compensation likely would head to the next GST council meeting.

CA Kalpak Kaplash