The desperately and eagerly awaited news of the extension of GST Annual Return for Financial Year 2018-19 finally arrived at noon of the last filing date i.e. 30.09.2020.

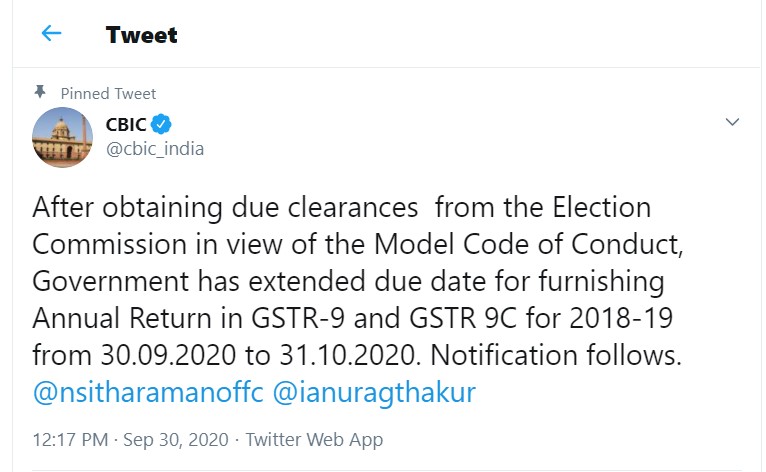

CBIC informed vide tweet that the date of filing of GST Annual Return has been extended by another month to 31st October 2020.

CBIC stated in its tweet that as the model code of conduct was applicable due to the elections announced in the state of Bihar, therefore due clearances were sought from the election commission, and after obtaining that the due date for filing Annual Return in GSTR 9 and GSTR 9C for Financial Year 2018-19 has been extended from 30th September 2020 to 31st October 2020.

Later during the day, the same was notified vide Notification No. 69/2020 (Central Tax) dated 30.09.2020.

Various representations have been made by ICAI, bar councils of tax practitioners, and business associations to the government requesting the extension of GST Annual Return FY 18-19 furnishing date along with other deadlines keeping in view the COVID 19 pandemic impact.

Social Media was quite abuzz regarding the extension of the GST Annual Return date. In view of the pandemic when other due dates were extended, the GST annual return for FY 18-19 was also likely to be extended. People kept pouring in with their tweets that as per sources GST 9 and 9C date for FY 18-19 was likely to be extended to 31st October 2020.

But the question was lack of clarity from the government regarding the same which created a situation of panic and confusion. As time was running out to comply with the deadline so was the patience of the people.

The delay in the announcement of date extension has been stated due to the fact that before announcement approval was needed to be taken from the election commission due to the Model code of conduct due to the Bihar Election which took time.

Though the extension has been announced by CBIC today, a big segment of practitioners is of the view that a one-month extension for the cumbersome GSTR 9 and 9C is not enough keeping in mind the pandemic effect which is impacting the working of offices.