Rule 86B imposes restriction on utilisation of the amount available in the electronic credit ledger while making tax payment of GST. The newly introduced Rule 86B says that to discharge his tax liability of GST, registered person would be allowed to use the amount of electronic credit ledger only upto 99% of the tax liability. This restriction would be applicable in case the value of taxable supply in the month other than exempted supply and zero-rated supply is more than fifty lacs.

Rule 86B has been added to the CGST Rules 2017 vide Notification No. 94/2020 dated 22.12.2020

Now at least 1% of GST liability is to be paid in Cash in case the taxable turnover in the month exceeds fifty lakh rupees. Utilization of Input Tax Credit would now be subject to Rule 86B.

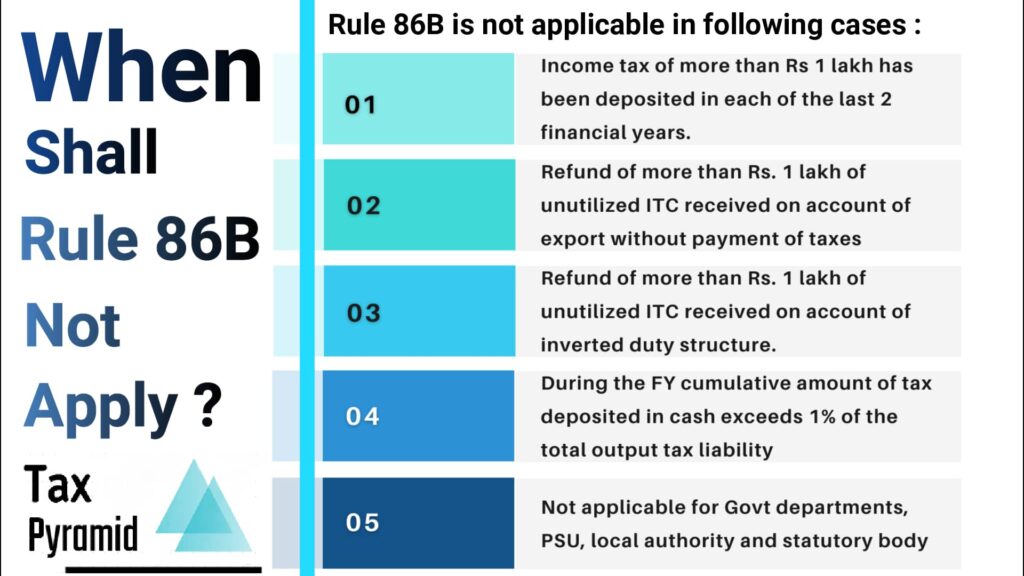

When shall Rule 86B not be applicable ?

Rule 86B, however, shall not be applicable in following cases:

- Income tax of more than 1 lakh rupees has been deposited by the registered person in each of the last two financial years.

- Refund of more than 1 lakh rupees of unutilised ITC received by registered person on account of export without payment of taxes i.e. export under LUT

- Refund of more than 1 lakh rupees of unutilised ITC received by registered person on account of inverted duty structure.

- The cumulative amount of tax deposited in cash in the current financial year exceeds 1% of the total output tax liability

- This rule of restricting the utilisation of ITC shall not be applicable for government department , PSUs, local authority and statutory body.

Taxpyramid Comments

Taxpyramid is of the view that the amount available in electronic credit ledger belong to the taxpayer and not allowing him to use that amount in discharging the tax liability seems not only harsh but also would increase the complexity of GST payment structure. The cash flow would take a hit, working capital going to be blocked and all of this in time of Covid pandemic.

The only respite in this amendment is that this restriction would be applicable only for the month during which the value of taxable supply exceeds Rs. 50 lacs. But still it doesn’t put all the small and medium taxpayers out of its fire line.

If the purpose of the government behind the Rule 86B amendment is only to increase the cash inflow for itself then it should also be understood that it is not only the government which is facing revenue crisis. Businesses are also dealing with the same crisis in Covid pandemic and are much more vulnerable.