While various tax deadlines which were falling due on 31st December 2020 were extended by the government today except the last date of GST Annual Return for FY 2018-19. The last date for filing of GST Annual Return in form GSTR 9 /9C for FY 2018-19 still remains 31st December 2020.

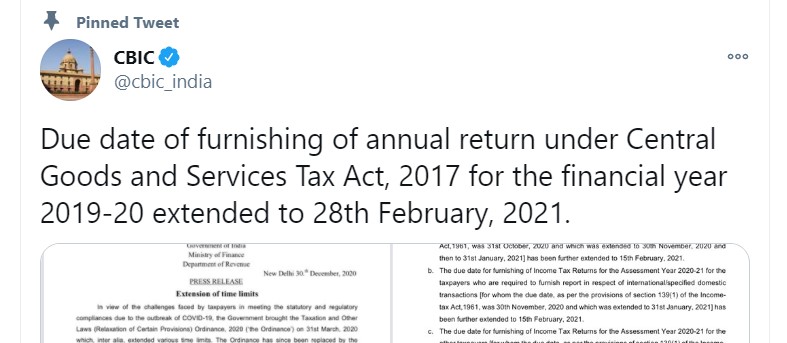

Although the date for filing of GST Annual Return for Financial Year 2019-20 has been extended from 31st Dec 20 to 28th Feb 21.

As per the press release issued by the ministry of finance today i.e. on 30th December 2020 , the time extension has been provided due to the challenges being faced by the taxpayers in complying with the statutory and regulatory compliances due to the Covid 19 pandemic outbreak.

The extension has not been on the expected lines as the extension of GST Annual Return for FY 18-19 was also expected considering the unprecedented pandemic impact on the businesses.

The offices are still not open with full strength as the Covid pandemic still looming large and been one of the main reason behind the professionals seeking extension in the due dates.

The businesses are gasping for a breath of survival since the unlocking and at the moment are busy putting their house in order. Experts believed that they could have been provided further relief as right now statutory compliances are not the priority of the hour since annual return is not a revenue-generating return.

Economy revival should have been the real focus. The non revenue generating compliances at least could be avoided pressing hard by the government. The collections of last two months have been encouraging, government must not let this momentum go and instead do all it can to provide a conducive environment to ensure the flourish of business and economy.