From 1st January 2021, Registered persons with an aggregate turnover of more than Rs. 100 crore in any Financial year from 2017-18, would be required to issue E-invoice. The same was notified by Central Government vide Notification No. 88/2020 CT dated 10.11.2020.

Further from 01st April 2021, E-invoicing is expected to be implemented for registered persons with more than 5 crore turnover.

Therefore through this article, we would try to understand how to generated E-invoice or how the IRN would be generated.

First of all, JSON file in respect of an invoice is to be generated. For this offline utility provided on e-invoice portal is to be downloaded.

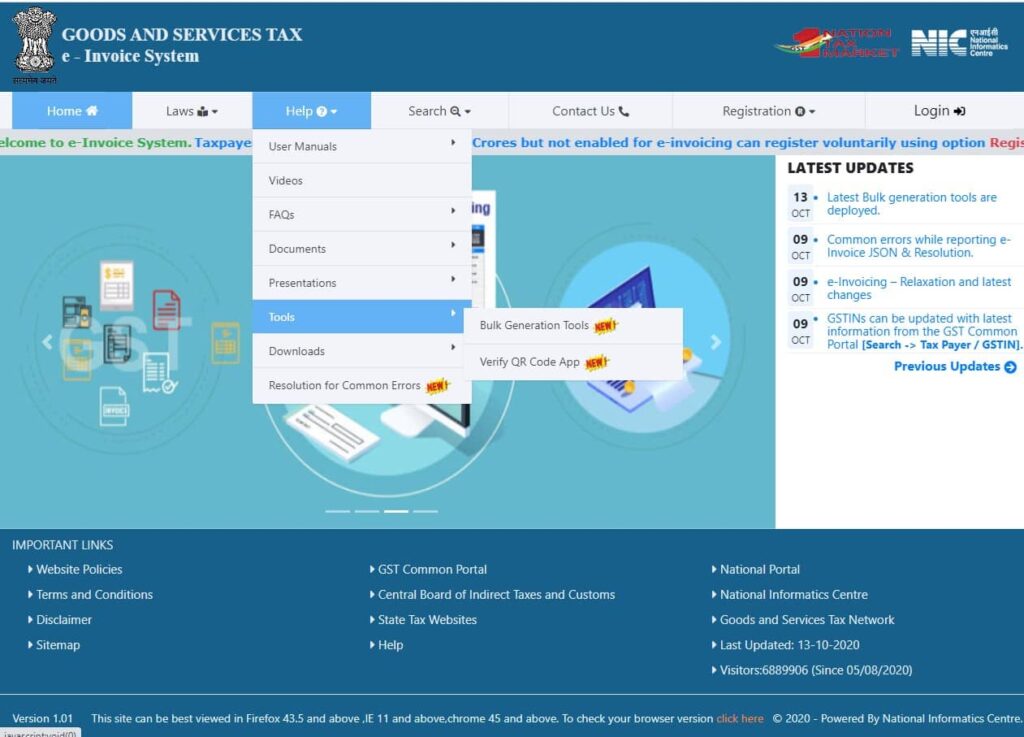

On the home page of E-invoice portal, https://einvoice1.gst.gov.in/, go to Help>>Bulk Generation Tool.

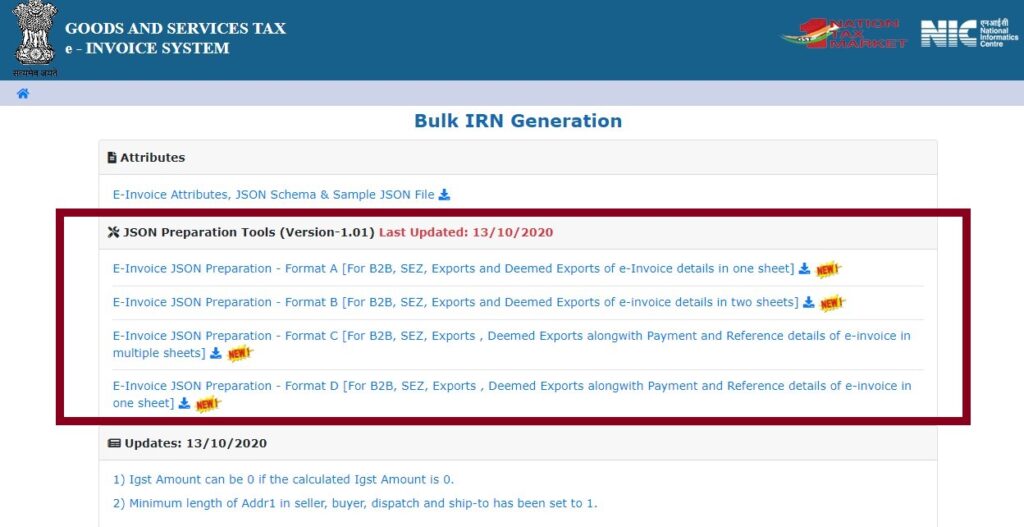

E-invoicing portal provides four different types of JSON file preparation utility tools which are named as Format A, Format B, Format C and Format D

These different formats are provided to serve the requirements of different types of taxpayers on the basis of transactions involved. The format suitable as per the transaction may be downloaded.

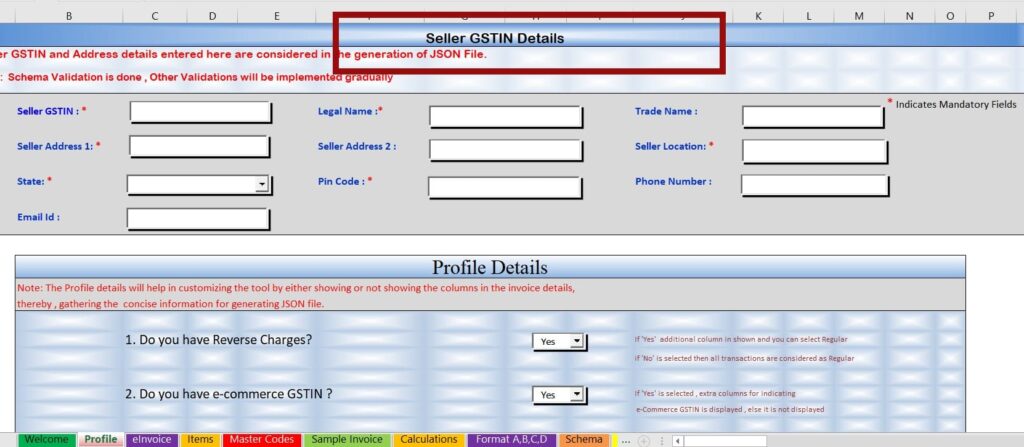

Seller GSTIN details are to be entered in the profile sheet and is a one-time entry. The profile sheet also requires the user to answer certain questions in Yes or No. On the basis of that, the utility customizes by hiding the non-relevant fields in the e-invoice sheet.

Format A has single worksheet which taxpayer may use when the invoice has only 1 or two items. All the details are on the single sheet including the item details. Through this format, the taxpayer can upload a large number of invoices through a single upload on the E-invoice portal.

The format doesn’t provide for payment and reference details. The same shall be available in the other fomrats.

Format B has two worksheets and enables the user to enter the item details in a separate sheet. This format is useful when there are multiple items in the invoice.

Format C has five worksheets that require the user to enter the invoice details, item details, payment details, reference details, and additional details to be entered separately.

The invoice may be used when the invoice has multiple items or requires entry of payment details such as bank account details, credit days, mode of transfer, and due amount or the user wants to enter the invoice reference details such as contract number, Purchase order details etc

Format D has a single worksheet and enables the user to enter all the details including the payment and reference details in one single sheet.

It is to be noted here that Format A doesn’t allow the payment and reference details while Format D does.

The format is useful where the invoice has one or two items but requires the information of payment details such as bank account number, no. of credit days, mode of transfer, or requires the entry of invoice reference details such as contract number, purchase order details.

Generation of JSON File

Using one of the formats, JSON file needs to be created.

Seller GSTIN details are to be entered in the profile sheet.

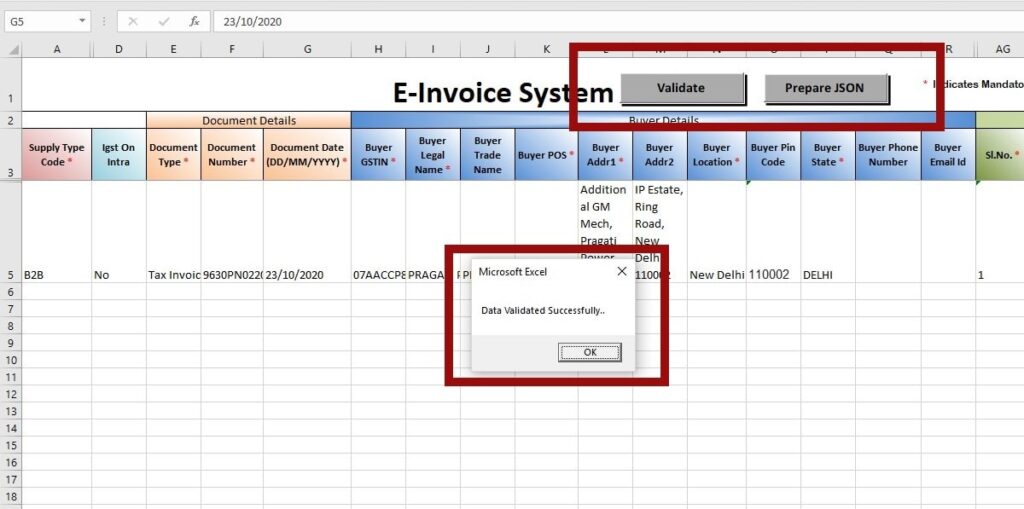

Invoice details are to be entered in the e-invoice sheet.

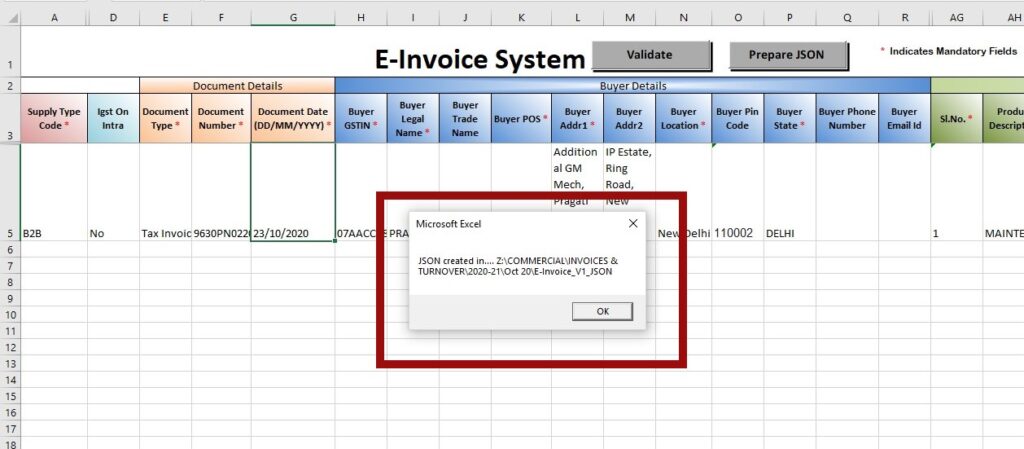

After entering the invoice details, the “Validate” button shall be clicked to validate the entered details.

In the case there are no errors, a “Date Validated Successfully” message would pop up.

After validating the data, press the “Prepare JSON” button on the E-invoice sheet and a JSON file would be created.

Generating the IRN

The created JSON file is now to be uploaded on the e-invoice portal for generating the IRN.

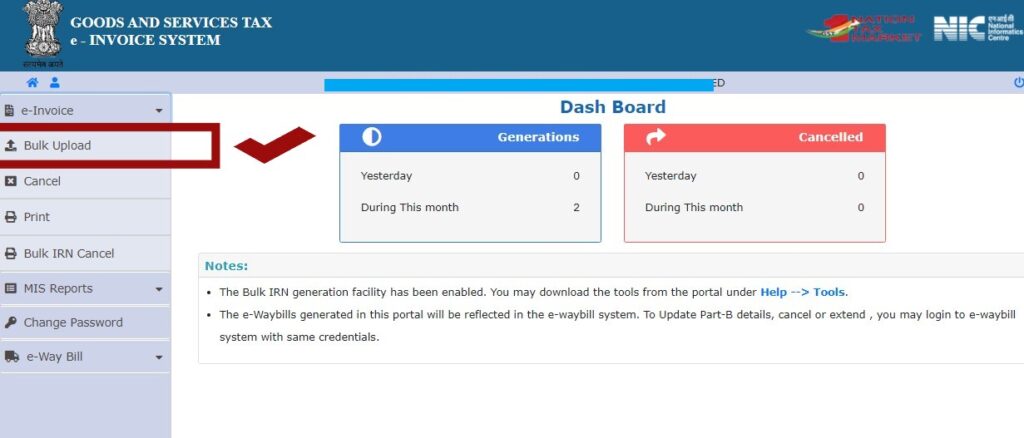

Login in to e-invoice portal.

In the e-invoice tab on the home page, select to the Bulk upload tab

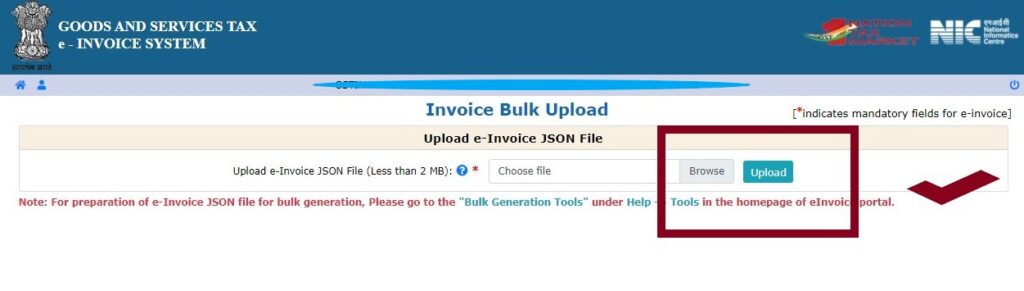

Invoice Bulk Upload window would open for uploading the JSON file. The size of the JSON file to be uploaded should be less than 2 MB

Through “Browse” button, the JSON file to be uploaded shall be selected and then the same shall be uploaded using the “Upload” button

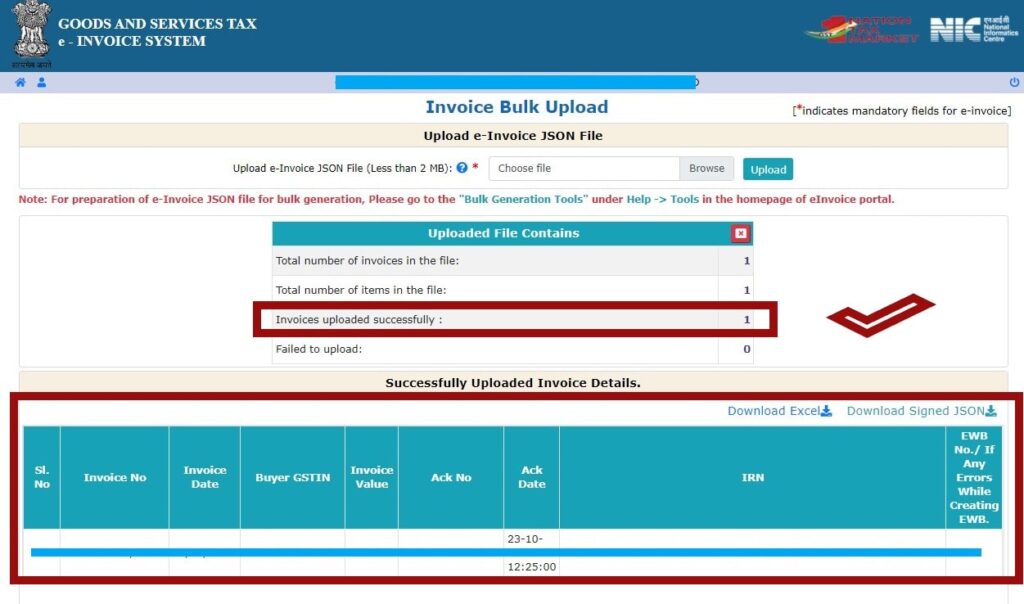

After the successful upload the following screen shall be displayed along with the Acknowledgement Number and IRN details.

The Acknowledgement Number shall be saved and would be used later to re-print the invoice at a later date.

IRN (Invoice Reference Number) is a 64 character which is unique for each invoice in the entire GST System during a Financial Year.

The IRN generated in respect of a invoice can be cancelled within 24 hours. After the lapse of 24 hours an IRN cannot be cancelled, after which it would require a Credit note to nullify the invoice IRN if created wrongly.

Keep this going please, great job!

It’s remarkable for me to have a site, which is valuable in favor of my experience.

thanks admin

Thanks for sharing your thoughts about e-invoice. Regards