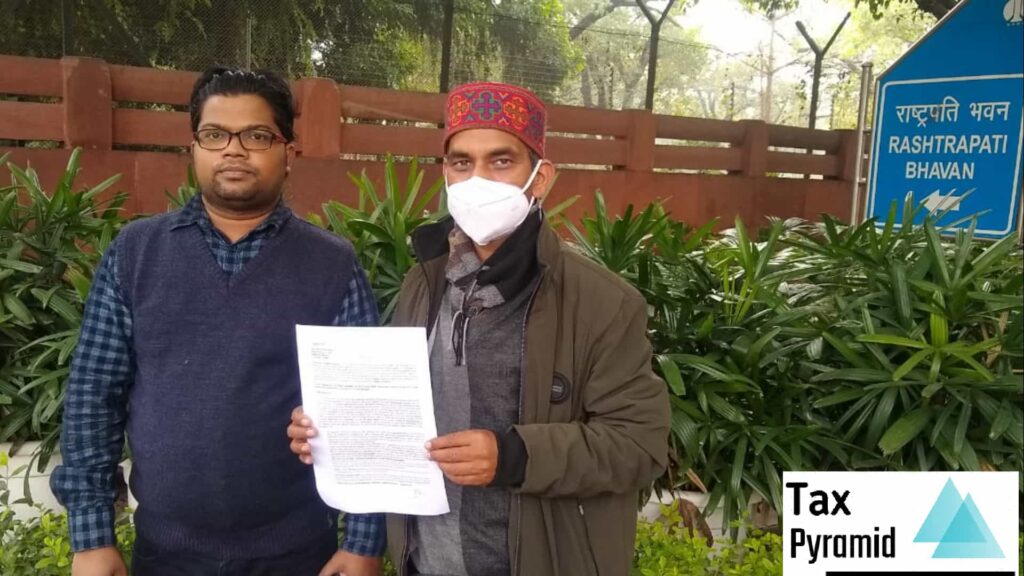

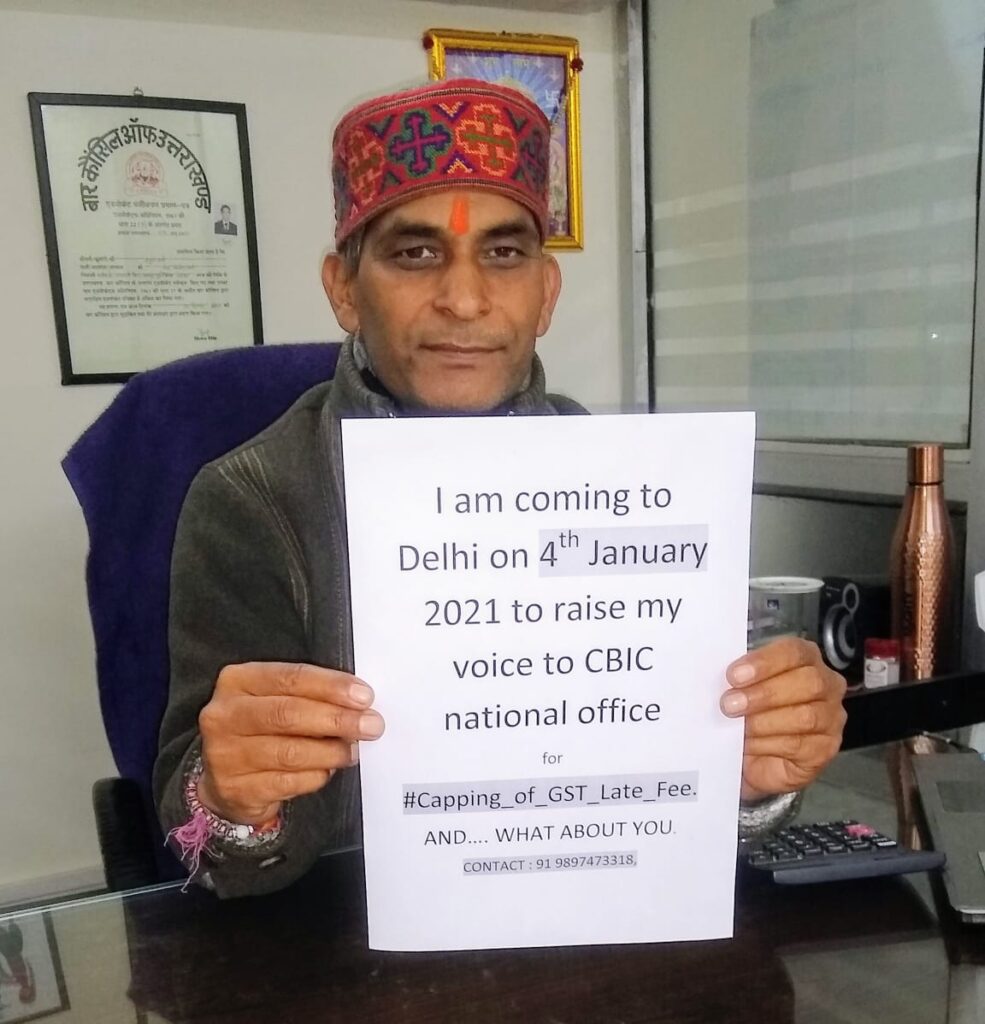

With a letter requesting GST reforms in hand, an advocate came to Delhi all the way from Dehradun to meet the Honourable President of India.

No gathering, no big delegation, no mass protest, no slogans, just along with his fellow tax professional, Subodh Kumar, from Delhi submitted the letter to the President Office on 4th January 2021.

His visit and his letter made waves over social media as it brought GST Reforms again to the fore of discussion. GST Reforms has been raised time and again by tax professionals through various possible forums. A letter straight to the highest office can be seen in line with the series of efforts being made to raise the issues regarding GST reforms to the appropriate level.

Kalpak Kaplash had a discussion with Advocate Anuj Bhatt regarding the letter submitted to the Honourable President’s office for GST reforms. Let’s try to understand the underlying insights regarding the GST issues straight from the man.

Interview with Advocate Anuj Bhatt

Tax Pyramid: Advocate Anuj Bhatt has been one of the strong voices for tax professionals over social media who has been continuously raising issues regarding GST reforms. His Facebook live sessions resonating the GST related concerns have been quite popular. First of all, I would like to congratulate you for the efforts you are putting in for GST Reforms.

Thanks, Dear CA Kalpak Kaplash ji, for giving me this honor and to discuss such important issues here in “Tax Pyramid”.

I am just a small tax consultant who is loyal to his clients. Therefore, I consider it as my duty to bring to the notice of the authorities the issues which are being faced by the public at large.

And I am happy these efforts are beginning to show at the national level as people are discussing these issues. The credit goes to all of us, including you who have been involved in raising the GST reforms for quite long. The efforts show that professionals and businessmen at the national level are unitedly raising these issues point by point.

Tax Pyramid: You have come all the way to Delhi from Dehradun to meet the Honourable President of India. Kindly tell our readers What was the purpose of the visit?

As you are a Chartered Accountant yourself, you are aware that after the GST coming into existence in 2017, the path has not been easy for Tax Consultants. In order to correct even the minor nuances, we have to repeatedly ask the department for it.

There are certain issues in the GST system which have been repeatedly requested to be addressed. These issues are severely hurting the businesses, tax professionals, and the GST system itself.

Our workload has repeatedly increased and we are not able to complete the work even after working late in the office. There is no hearing anywhere and at the same time going to court is not an option. For the resolution of problems coming to our profession, we should talk to the government and resolve them mutually.

Hon’ble President Sir is the most respected first citizen of India, He is the Guardian of our Constitution. I had to go there to bring these issues to notice of the supreme authority on behalf of my Tax Professional brothers, and all small businessmen in the country, who are mentally and economically being tortured and that’s why we made a request to His Majesty.

Tax Pyramid: It was more like a silent gesture from your side. I mean no crowd, gathering, protests or slogans almost contrary to what is seen nowadays in fashion how people raise their voice or dissent. And that is despite of the fact that this issue has a lot of support from tax professionals and businessmen.

We don’t want to come out in protest against the government, raising slogans, picketing, or demonstrations. All we want is to unitedly raise our issues genuinely to the government for resolution. There is nothing against the government. Moreover, it’s like help to mutually improve the system.

Tax Pyramid: You have submitted a representation to the office of the Honourable President of India. The letter is all over social media. We know that this letter is related to GST reforms and GST reforms are a bit broad kind of spectrum. What kind of reforms you are actually demanding from the government?

The very first request is that GST amnesty 2020 shall be extended till 28th Feb 2021. Since the market, after lockdown came into its full operation only after October during which Diwali, Dussehra, Eid, wedding festivals started, it was then only the businessman was in a situation to deposit his taxes with full compliances. But the scheme was only till 30 Sep 2020. It means that the Late fee for a year was Rs.6000/- up to 30 September 2020, and from Ist October 2020, it would jump to more than a lakh of rupees. Is this Justified in this pandemic?

Secondly, the Date of Revocation of Cancellation is also to be extended at least till 28th February 2021. There were so many GST registrations that were canceled on or before 12th June 2020 and were further applied for revocation of cancellation of their GSTNs under this scheme. In this process those registrations which were restored after Ist October 2020 while reduced late fees under GST Amnesty were up to 30th September. These taxpayers will have to pay heavy late fees from the date of the last filed return which is obviously not due to their fault. Please consider the hardship of lockdown and pandemic also. Title “Removal of Difficulties Order 2020” has no meaning.

Further, we have requested for revision facility in GSTR 3B.

Tax Pyramid: There were a lot of requests from tax professionals regarding relaxation in Section 16(4). This issue also finds a mention in your letter to the Honourable President. Right?

As per section 16(4) the input credit can only be taken up to a definite period but during the initial 2 years of GST, lot of dealers have made a mistake of not taking the credit within stipulated time. They are not allowed that credit although the Government has already received the tax under consideration when the seller deposited it.

If this credit is not given then it will tantamount to double taxation on a single transaction because at first stage the purchaser has paid the tax to the Seller who in turn has deposited to the Government and at second stage department is not giving him the credit so he is required to pay it again. It is a big hardship to these dealers. As GST itself was at initial stage at that time and not fully stabilized, so it should consider the mistakes committed at the end of businesses. These mistakes should not be punishable with losses like this to businesses.

Further, the time limit provided under Sec 16(4) is too less and should be relaxed.

Tax Pyramid: Through your letter you have also raised concerns regarding GSTR -10 also. Kindly throw some light regarding it too.

The Dealers who have surrendered their RC and does not have any tax liability and having no stock, still they have to file a final return GSTR-10. In most of the cases these returns are NIL but if forgotten then they have to pay a late fee amounting to Rs. 200.00 per day subject to maximum of Rs. 10,000/-. This late fee is a harassment and big burden on the dealers who have already surrendered their registration certificates.

Further this GSTR-10 has to be filed after order of the cancellation of the RC and it is again a big problem. Sometimes it is ordered within 15 days of applying the surrender and in some cases, it takes as long as 6 Months. Now the dealer who surrendered his Registration has to keep track of this formality.

Please consider the problem associated with this form GSTR-10 and practically this form should be taken with the application of surrender of RC and in NIL cases if the return is not filed please waive the late fees further the NIL GSTR-10 has no purpose hence it should be made optional who has nothing to file in it.

Tax Pyramid: How hopeful are you from the government in regard to the requests you have made?

I am quite positive and that’s why I have gone before the Hon’ble President Sir. He will forward a letter to the concerned ministry with making instruction to look into the matter or it would have been sent when I am giving you this interview.

When the supreme and most respected citizen of the country would ask the government to take cognizance of matters, then the government will consider it for sure. I believe that.

Tax Pyramid: GST was introduced itself as the biggest reform till date and now the irony is that these reforms themselves require further reform. How do you see it?

See, India is a developing democratic country, where there are 28 states and 8 Union Territories. In such a large country, it has been more than 3.5 years of GST in India, with 100% paperless, and 100% online system. Therefore, in such a large country GST implementation is not a small wonder. At the same time, this achievement of the government also has the huge contribution from tax advisers and traders of the country.

Reforms in any system is a way forward. Only by making strict rules, we will not only be able to reform the tax system. It is the responsibility of the government to eliminate the huge compliance burden which is not happening right now. Presently the situation is such that if the person has failed in the Compliance of GST, he cannot find a way out. Heavy Fine, Penalty, Cancellation, Provisional Assessment are there. Now if he wants to rectify his mistake and come to the mainstream, then how come? You tell. Can charging huge late fees be the only purpose of the government?

Tax Pyramid: What new challenges now in the GST regime are there that you have to deal with as a GST Practitioners?

Kalpak Ji, the businessman has to understand that we are only helping hands, it is they who have to be serious about their Compliances. Timely data should be provided along with other required particulars. We do not have only one client or one job at hand, they will have to understand what are our actual requirements to comply on their behalf. At least once a month, they should come to visit their tax professional and discuss the issues. Today the real challenge in the GST regime, businesses need to be more serious towards their own compliances.

Tax Pyramid: Covid-19 pandemic impact undoubtedly is huge. We see a lot of posts on social media regarding GST Amnesty. Kindly tell our readers What is this GST Amnesty?

See, for the third time in 3.5 years, amnesty was brought in and is a message something is not right with the system. When you are providing amnesty scheme, just think of those who have deposited huge amount of late fees in the pressure of the government and also with those who completed their Compliance on time. Quantum of punishment should be reduced once and for all. And that would be benefiting everyone, even those who are complying within time limits.

Tax Pyramid: There are lot of young people who are looking at GST as a career. As a GST practitioner, what message would you like to give to those young aspiring GST practitioners?

Do your work before time. Get all data and other documents in time. Classify your clients. Do not let the client depend on your phone calls, that he will give you his data only after your call arrives. Inform every client about his compliance from time to time, when to do it, and the procedure. Relieve yourself from fear that the client will go anywhere else. Quality service providing should preference. Rest is ok. I wish all the best to the young practitioners.