TDS u/s 194Q on purchase of goods is the newly introduced TDS provision inserted in the Income-tax Act through Finance Act 2021 which would be effective from 01st July 2021.on

TDS u/s 194Q on Purchase of Goods: Introduction

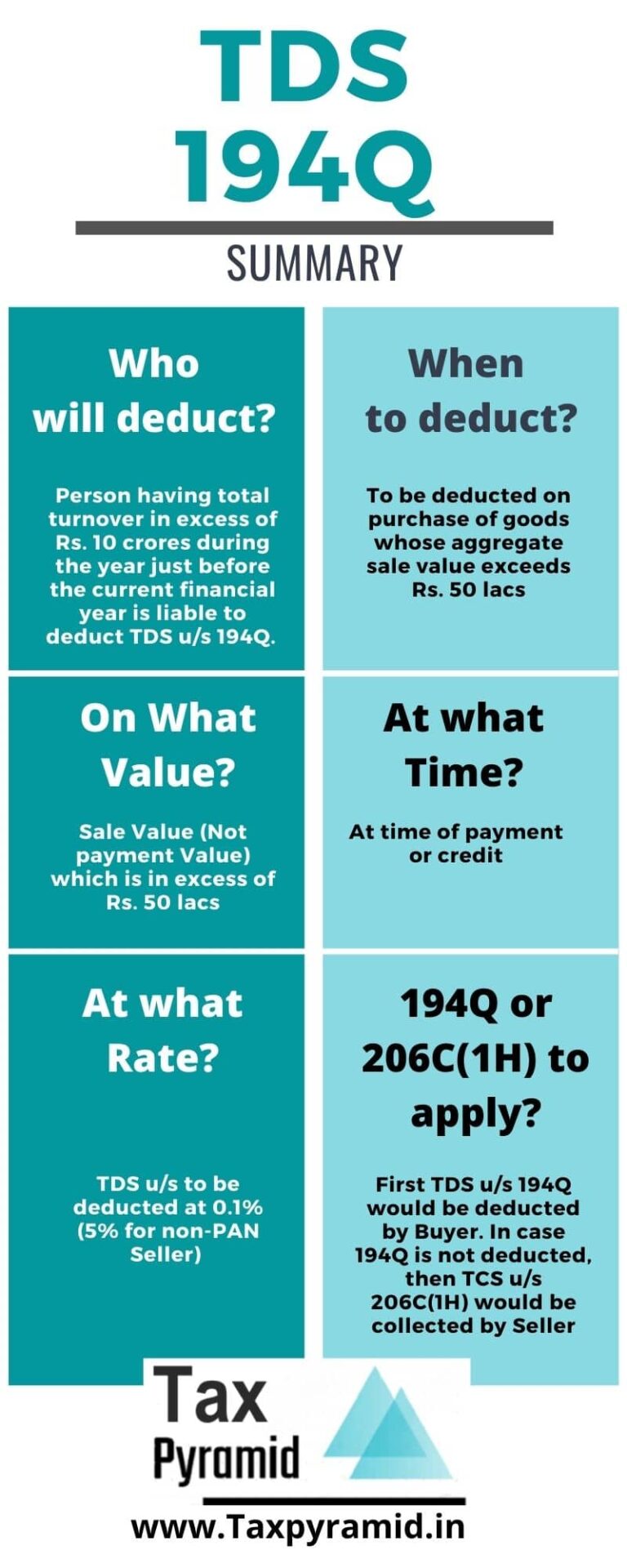

194Q requires deduction of TDS by the ‘specified buyer’ of goods at the time of payment of amount or payment credited in the books whichever is earlier, if the goods are purchased from a person for aggregate value of more than Rs. 50 lakhs. TDS would be deducted on value which exceeds aggregate value of Rs. 50 lakhs.

If the ‘specified buyer’ purchase of goods of value more than Rs. 50 lakhs from a person during a financial year then he would now have to deduct the TDS at the time of payment or credit of his books whichever is earlier

For this section eligible or ‘specified buyer’ would be the one whose total turnover or gross receipts is more than Rs. 10 crores during the financial year immediately preceding the year in which the said purchase took place for which applicability of 194Q is to be decided.

Example 1:

If we are deciding for applicability of TDS u/s 194Q for FY 20-21 then the total turnover or gross receipt of FY 19-20 shall be checked whether it exceeds the threshold limit of Rs. 10 crores or not. In case it exceeds Rs. 10 crores in FY 19-20 then such person would be liable to deduct TDS u/s 194Q in FY 20-21.

Example 2:

A buyer having 11 crores turnover in the previous year makes purchases of 40 lakhs from Seller ‘X’ and 45 lakhs from Seller ‘Y’. The buyer despite making aggregate purchases for 95 lakhs still would not be required to deduct TDS u/s 194Q as the aggregate purchases from any seller doesn’t exceed 50 lakhs.

Important points for TDS u/s 194Q application

- Tax is required to be deducted at source by a purchaser of goods whose turnover for previous financial year has exceed Rs. 10 crores.

- The seller of goods should be a resident of India. TDS u/s 194Q would not be required to be deducted in case of import purchases. Sale by non-residents have been excluded.

- TDS shall be applicable only on purchase made from those sellers from whom the value or aggregate value of purchases during the financial year exceeds Rs. 50 lakhs

- TDS u/s 194Q shall not only be deductible on payment basis but also when the amount is credited as payable in the books of the buyer whichever is earlier. In case the buyer has not made payment to the seller but has credited the amount in his books then also the provision of TDS would apply. Therefore, even when the buyer recognises the amount as payable and books the liability on the account then also the provision of TDS shall apply.

- TDS rate shall be 0.1% on the value of amount paid or credited. In case the PAN of the seller is not available, TDS rate shall be 5%.

- Provision of TDS u/s 194Q would not be applicable, in cases where tax is deductible or collectible under any other provisions (eg- motor vehicle or jewellery etc.) of Income Tax Act except TCS u/s 206(1H).

- It shall also be noted that if a transaction qualifies for TDS u/s 194Q and the same is deducted by Customer then the same transaction would not attract TCS u/s 206C (1H). The primary responsibility is of buyer to deduct TDS u/s 194Q on the transaction.

CA Kalpak Kaplash